Charts of Interest

January 14, 2026 Please don't ask me to argue with the price move in Bitcoin. I had suggested 10 days ago that a sustained move through the 94,330 level would set up for a challenge of the top of the Cloud leading to my measured move price target of 103,550. Yesterday, price resistance at the 94,330-price level was overtaken after prices held the 50% level of the sideways trading range and lifted off from support at the Kijun Plot. Short Term KST continues to rise above its signal line. It still has the upside price momentum to continue to rally. Today's follow through, held the breakout level and is challenging Cloud resistance. Through the Cloud puts the measured move target at 103,550 in the cross hairs of the bulls. Feet don't fail me now!

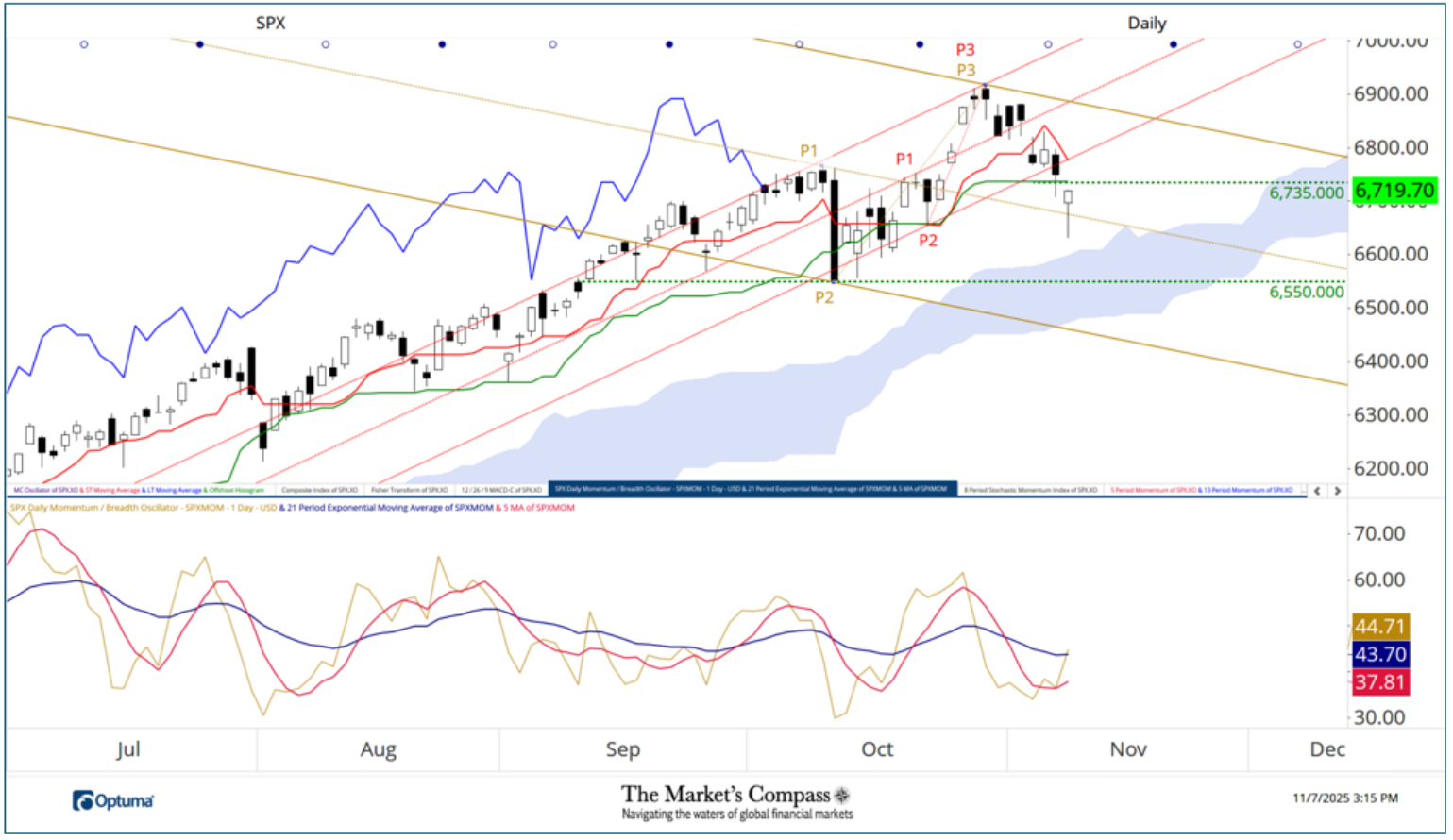

November 7. 2025 Yesterday the SPX Index violated and closed below support at the Lower Parallel (red line) of the Standard Pitchfork (red P1 through P3). Today prices fell below the Kijun Plot (green line) (6,745) and the Median Line of the longer-term Standard Pitchfork (gold dashed line) but has recovered. Still an underlying bid? Note the short-term higher low in the Momentum / Breadth Oscillator in the lower panel.

November 3, 2025 The iShares MSCI World ETF (URTH) advance was capped twice early last week at the Upper Parallel (solid gold line) of the shorter-term Standard Pitchfork (gold P1-P3) and promptly fell below the Median Line (gold dashed line) but managed, on a closing basis Friday to tentatively avoid a violation of the Lower Parallel (lower solid gold line). What concerns me is the lower high in the DM Country Momentum / Breadth Oscillator and that the oscillator has now fallen below both moving averages. The Tenkan Plot (red line) may offer a touch of support, but I am marking key first short-term support at the Kijun Plot at 182.60. Unless the URTH can retake the ground above the 187 level the URTH may be due for a correction of a larger degree than we have seen since the October 10th low/

October 3, 2025 #LTC Over the past three days Litecoin has lept above multiple potential technical hurdles of resistance starting with the Kijun Plot and Median Line (gold dotted line) of the newly drawn Standard Pitchfork. Through the twist in the Cloud and the Upper Parallel of the Schiff Modified Pitchfork and today, the Standard Upper Parallel. All in concert with MACD turning up through its signal line into positive territory.

September 28, 2025 The shorter-term daily chart of SPX paints a slightly different picture than the Weekly’s. Last Monday the S&P 500 Index notched another record high, but a continuation of the rally was capped at the Median Line (gold dotted line) of the Standard Pitchfork (gold P1 through P3) and a three-day price retracement unfolded but on Thursday prices held support at the Lower Parallel (solid gold line) of the Pitchfork. On Friday the large cap index recovered a portion of last week’s losses but the SPX Daily Momentum / Breadth Oscillator in center panel continues to be a niggling technical concern as the series of lower highs remain in place. With it, the Stochastic Momentum Index is tracking sharply lower below its signal line after rolling over from a lower high in overbought territory. These technical features lead me to believe that the support at the Lower Parallel is in jeopardy of being violated and at the very least key support at the Kijun Plot (green line) will be tested at the 6,525.00 level.

September 22, 2025 Bitcoin was unable to take advantage of the twist in the Cloud and extend the rally from the price pivot low at red P2 and turned lower late last week and today fell below my trend marker (TM, brown dashed line) and the Kijun Plot (solid green line) but has since recovered a portion of its losses. IF Bitcoin closes below the Kijun Plot this pullback will extend, placing the Median Line (green dotted line) of the Standard pitchfork into play (green P1 through P3). You don't need to look at the Stochastic Momentum Index to see the loss of upside price momentum but failing to confirm the red P3 high with a higher high in the oscillator was fair warning that there was trouble a foot. Only a turn and move above the red P3 price pivot high will give a potential all clear signal.

September 22, 2025 Wht follows is an excerpt from this morning's Developed Markets Country ETF Study that was posted to my Substack Blog...On the day of my last published Study on September 2nd the iShares MSCI World Index ETF (URTH) fell below the Lower Warning Line (gold dashed line) of the Standard Pitchfork (gold P1 through P3) that I have highlighted with a yellow circle. It recovered back above the Lower Warning Line the following Wednesday but there been two subsequent tests of that support but both times support held but prices have failed to reenter the confines of the Pitchfork. Since the start of the month there have been two more failures of the DM Country ETF Daily Momentum / Breadth Oscillator to confirm two new closing highs (vertical dashed lines). The indictor has now fallen below both moving averages.

I have bought attention to more than one indication that the Developed Markets I follow have not endorsed the move in the URTH. But it remains to be seen whether these indications like chickens will come home to roost and produce a correction of a larger degree in price. I think that the odds suggest that they will.

September 15, 2025 This past weekend I introduced a new overbought/oversold and price confirmation/divergence indicator that with my friend at Optuma, Darren Hawkins, helped me code into an oscillator (note that it is still in beta mode). It will be a regular chart feature in The Markets Compass Sweet Sixteen Studies. It tallies the eight objective Technical Condition Factors into one indicator that ranges between 0 and 8. As can be seen above when prices continued to fall in the first quarter of this year the Total Technical Factor Oscillator did not decline in concert with the index price decline (vertical dashed lines) signaling the price pivot low at violet P3. Moving average crossovers is also a valuable signal. Note that when 5-Week EMA (red line) tagged and rose again above the longer-term 21-Week SMA in late July it marked a price pivot low at Gold P3. More on this in the weeks to come.

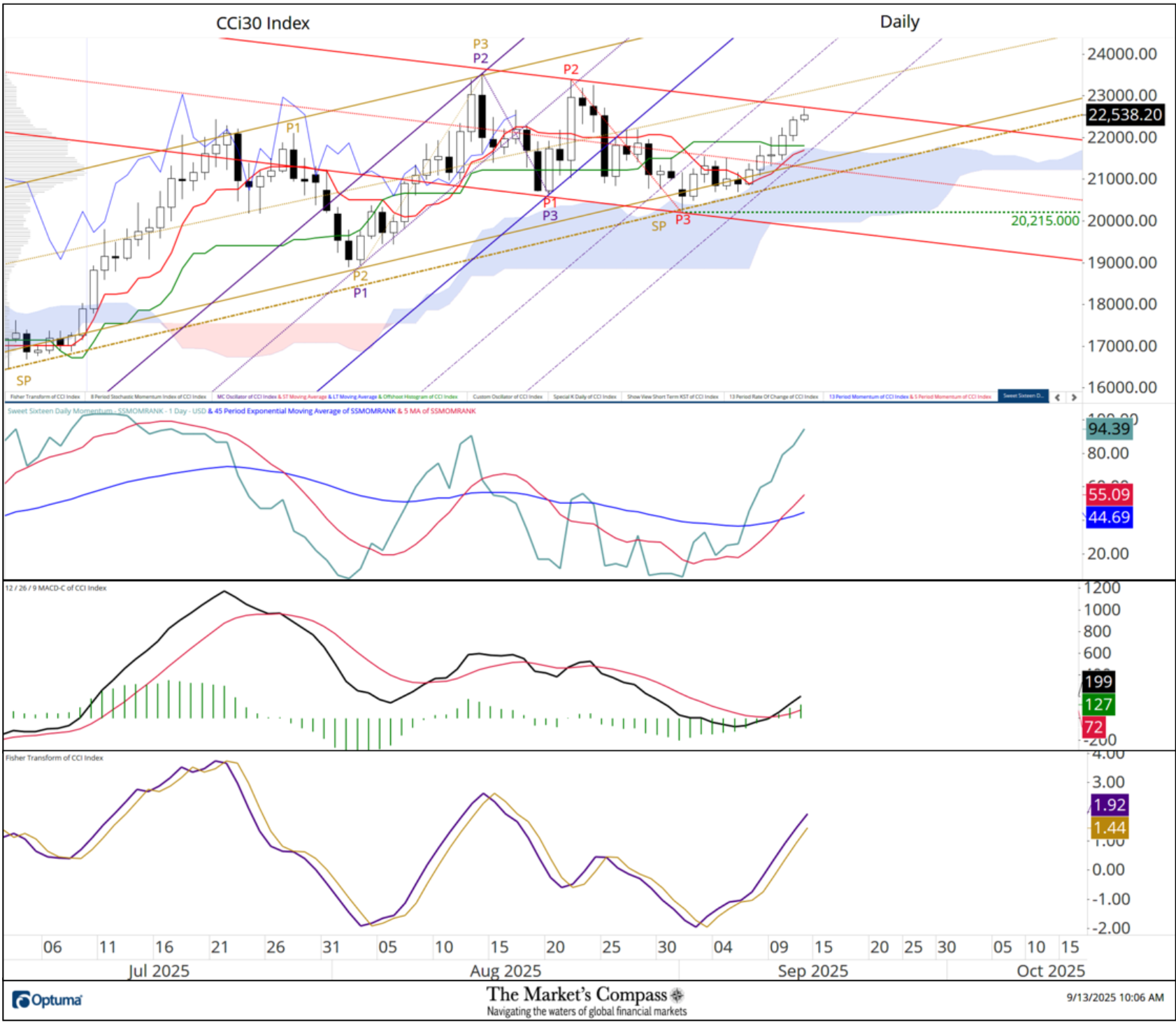

September 14, 2025 A week ago, last Monday, The CCi30 Index fell below support afforded by the Lower Parallel (solid gold line) of the longer-term Schiff Pitchfork (gold P1 through P3) but the Sliding Parallel (gold dashed line highlight with the gold SP) contained a further decline and over the remainder of the session it recovered a portion of its losses. Sliding Parallels are drawn at the same vector of the Pitchfork and as can be seen historically (look back to late June and early July for confirmation) have proven themself as a second level of support*. At the risk of “over forking” the Daily chart I added a third Schiff Modified Pitchfork (red P1 through P3) which had proven its short-term validity by the Median Line (red dotted line) capping daily advances until last Monday when it traded above it after holding Cloud support. On Friday the index was challenging the Upper Parallel (solid red line) of the newly drawn Pitchfork. The turn in the Sweet Sixteen Daily Momentum / Breadth Oscillator, in addition to the turn above the signal lines of the Stochastic Momentum Index, and the Fisher Transform adds to even more credence that a key price pivot low has been marked at red P3.

September 5, 2025 I had stopped for a late breakfast at the River View Diner in Edgewater NJ on the west side of the Hudson River. The Diner is 30 years old and likely had a view of New York at one time, but it now is a misnomer with the massive construction in that area. There were two ancient men two booths away from me. They were griping about rising medical costs, Medicare, food prices and their “pain in the ass near death wives. Then one of them drops this gem: “Good thing I held on to my NVIDA after I sold my government bonds in April, I’m told earnings should crush it this afternoon, or so my grandson says, and he and his friends are long up the ass”. Hearing that reminded me of another incident back in 2000 when the burst in the Tech Bubble was just beginning to deflate. I had left my office on Broad Street after the close and walked down the steps to grab the #4 train uptown to meet clients. As I stood on the crowded platform waiting for the train, I overheard two young Brokers I recognized from Harry’s a few nights before chatting it up. “I sold my tech stocks” said one, “but I’m hanging onto my Biotech stocks”. “Yeah, I agree, they should weather the storm”. What these young bucks failed to consider was Biotech was just as over owned as Beenie Babies in the early 1990’s. Day’s later the CEO and I wrote a one-off published piece that discussed the crazy projected earnings and revenue assumptions that would follow and my technical concerns regarding several of them. The piece was picked up by Barrons and on Monday morning the phones lit up like Christmas trees. One client (who had sizeable Biotech position) screamed, YOU! No More Business for you. The chart above of Biogen shows what happened over the months that followed. I am not even being to say that my partner and I predicted or were responsible for the carnage that followed, only that when everyone owns it who’s left to buy? Very similar to when everyone at the cocktail party is touting something it’s best to run away.

August 19,2025 At the risk of being labeled the boy that cried wolf there are early signs of a crack in the back of the NASDAQ 100’s rally. Including a violation of the Lower Warning Line of the Standard Pitchfork, a repeated non-confirmation of the higher price highs in the Momentum / Breadth Oscillator (vertical red lines), a break of the trend in relative outperformance versus the SPX and a sharp turn lower in the Stochastic Momentum Index. Stay tuned!

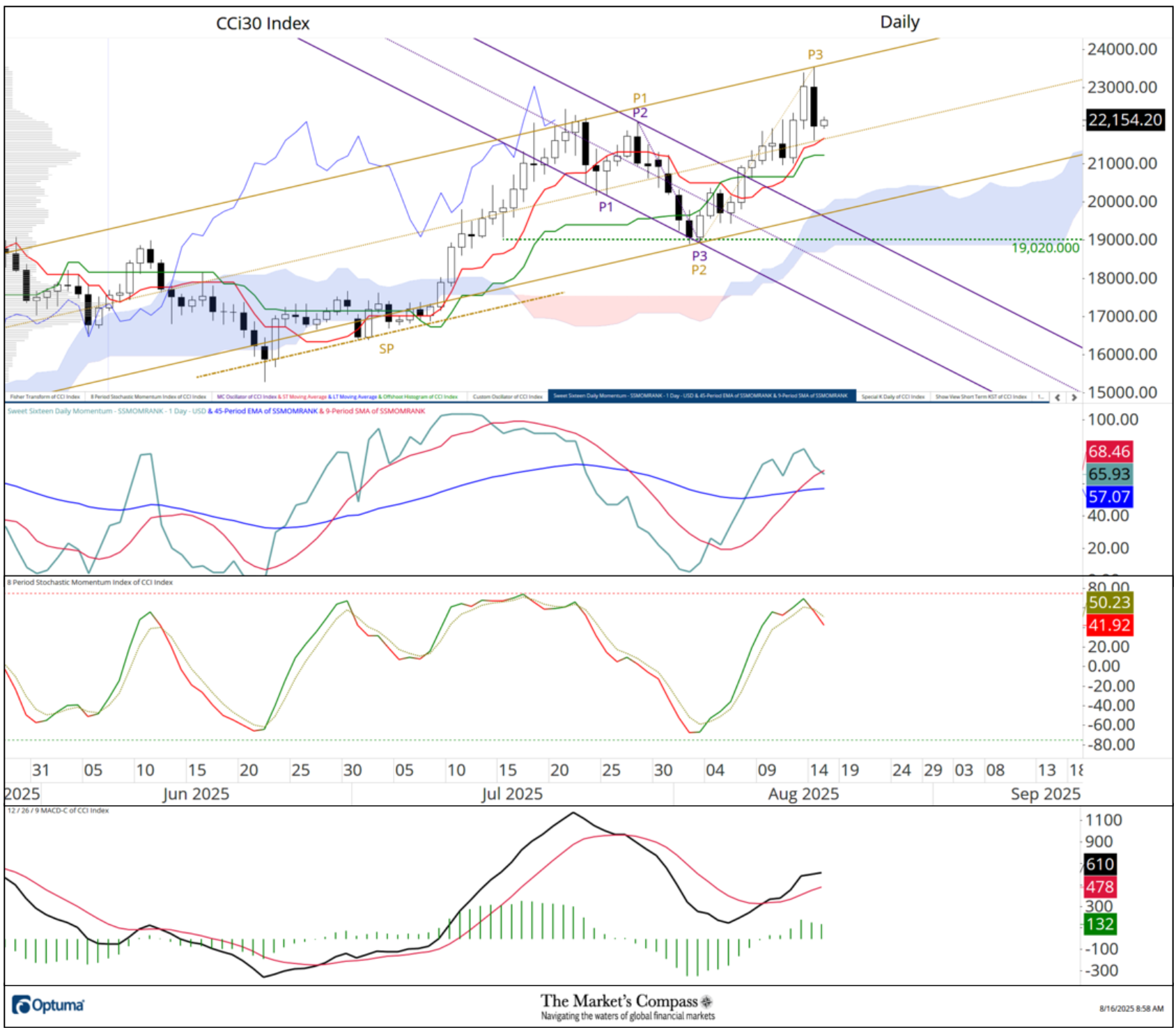

August 17,2025 After the CCi30 Index overtook the Upper Parallel (solid violet line) of the Schiff Modified Pitchfork (violet P1 through P3) a brief period of backing and filling unfolded until early last week. On Wednesday the broad-based index rallied and closed at a new daily closing high. On Thursday a sharp reversal unfolded leading me to draw a new shorter-term Schiff Pitchfork from the intra-day high. I chose that variation of pitchfork after a lookback to June and July when on a closing basis, prices held a sliding parallel (gold SP) that was at the same vector of the new pitchfork. Thursday’s reversal bounced off the Median Line (gold dotted line) and the Tenkan Plot (red line). The Sweet Sixteen Daily Momentum / Breadth Oscillator has edged below the shorter-term moving average (red line) but it remains above the longer-term 45-day exponential moving average. It’s surprising that the Stochastic Momentum Index has fallen from being overbought during Thursday’s price weakness but MCD to still tracking quietly higher above its signal in positive territory. Holding Median Line support is key to any bullish argument.

July 28, 2025 After stalling at the Upper Parallel of the Standard Pitchfork, the $SPX held the Median Line as support and ground to new highs Friday.

Momentum?✔️ Higher low in the Breadth Oscillator✔️ Stochastic Momentum Index turning up again above its signal line✔️ MACD steady in positive territory, The slow-moving freight train rolls on. A break below the Median Line = caution. A break above the Upper Parallel = blue sky ahead. Next support: 6,147.43

June 22, 2025 A week ago, last Friday the CCi30 Index* violated support at the Median Line (violet dashed line) of the Schiff Pitchfork (violet P1 through P3) and for intents and purposes has been trapped below it since. The grind lower in the Sweet Sixteen Daily Momentum / Breadth Oscillator continues since the lower high two Wednesday’s ago and is approaching oversold territory but the rejection of the shorter-term 9-day (red line) at the longer-term 45-day moving average is concerning. Both MACD and the Stochastic Momentum Index continue to track lower below their signal line as does the Fisher Transform. The weight of the above technical evidence suggests key price support at the P3 price pivot low at 16,500 will be tested.

The CCi30 Index is a registered trademark and was created and is maintained by an independent team of mathematicians, quants and fund managers lead by Igor Rivin. It is a rules-based index designed to objectively measure the overall growth, daily and long-term movement of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding stable coins (more details can be found at CCi30.com).

June 22, 2025 A BEARISH STEW! A week ago last Wednesday the EEM traded at a new recovery higher high but on Friday the ETF violated and closed below support at the Kijun Plot (solid green line) and broke price support at the 46.50 level. In addition to those price failures, the lower high in the EM Country ETF Daily Momentum / Breadth Oscillator (highlighted with yellow dashed vertical lines) and its failure to retake the ground above the 45-day exponential moving average (blue line) and the subsequent violation of the shorter term 9-day simple moving average (red line) as the oscillator probes lower levels adds to the “bearish stew”. MACD remains in positive territory but has rolled over through its signal and the Stochastic Momentum Index is gathering a pace lower. At the very least a test of support at the Lower Parallel (solid violet line) and potentially price support at the 45.50 level is in the cards.

June 15, 2025 Last Monday the CCi30 Index rallied sharply (yellow circle), rising back above the Median Line (violet dotted line) of the Schiff Pitchfork (violet P1 through P3), the Kijun Plot (green line), and the Upper Parallel (solid gold line) of the longer-term Standard Pitchfork (gold P1 through P3). The rally from the violet P3 low failed at the upper Parallel of the Schiff Pitchfork (solid violet line) and prices reversed course over the balance of the week. The only consolation was that the selection of the Pitchfork variation (Schiff) was correct being confirmed at Upper Parallel resistance. On Friday the broad Index broke Cloud support as investors high tailed it out of risk assets, but managed to recover and close on Median Line support (blue dotted line).

That said the three-day slide lower has resulted in the momentum oscillators rolling over with both MACD and the Stochastic Momentum Index rolling over through their signal lines in concert with a turn lower in the Fisher Transform. The Sweet Sixteen Daily Momentum / Breadth Oscillator has fallen through both moving averages and is probing into oversold territory but has not reached an oversold extreme. Key support at the price pivot low, at 16,500, must hold, or a deeper pullback can be expected.

June 8, 2025 A week ago, last Friday, price fell and closed below potential support at the Kijun Plot (green line) and in the days that followed the Kijun Plot capped any attempt to retake the ground above it. On Thursday and Friday Cloud Model support came into play and the CCi30 Index is teetering on the Cloud bring key support at the 16,300 level into the sellers’ crosshairs. MACD has fallen into negative territory and although the Stochastic Momentum Index is approaching a level that has led to rallies in the past it has yet to signal a turn as it produces a new low. The Sweet Sixteen Daily Momentum Index has reached a level that has led rallies in the past but until it prints a higher high and it is able to escape the downtrend in the oscillator and key support at 16,300 level is able to hold, it’s best to watch and not “stick a toe in the water”.

The CCi30 Index is a registered trademark and was created and is maintained by an independent team of mathematicians, quants and fund managers lead by Igor Rivin. It is a rules-based index designed to objectively measure the overall growth, daily and long-term movement of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding stable coins (more details can be found at CCi30.com).

June 1, 2025 We were forewarned of the potential that the EEM could roll over when my EM Country ETF Daily Momentum / Breadth Oscillator failed to mark a higher high when the EEM did (yellow dotted line). The shorter-term 9-day SMA (red line) has fallen below the longer-term EMA (blueline) and the oscillator has fallen below both. The other three oscillators are tracking lower below their signal lines. Although there could be a small measure of support at the Kijun Plot (green line) at 44.85 there is little hope that will offer meaningful support considering the other technical features mentioned above.

May 30, 2025 Yes, with the break below the lower confines of the roughly drawn channel delineating the uptrend from the April lows there could be a counter trend move of a larger degree developing from the April lows but that does not suggest that there will be significant price damage. Any price pullback should find initial support at the Kijun Plot (solid green line) and secondary support at 98,710 and the .382 retrace of the rally. It wasn’t a surprise that the price pullback from a week ago last Thursday high occurred, seeing that my Sweet Sixteen Daily Momentum / Breadth Oscillator failed to confirm that high. Despite the continued drop in both MACD and the Stochastic Momentum Index below their signal lines, what gives me confidence that there will not be an acceleration to the downside is that the oscillator has reached an oversold level that has led to price reversals in the past. In my opinion the worst-case scenario is a pullback to the .50 retrace level (currently at 93,300).

May 23, 2025 Hard to argue with today's price breakout in copper. The red metal has traded through the Upper Parallel (solid violet line) and out of the confines of the Schiff Modified Pitchfork (violet P1 through P3) and out of the Cloud putting price pivot resistance at 4.96 in play. Its got positive price momentum behind it.

The ENR 20-City Average Price of 1 1/2" Copper Water Tubing, Type L per foot has "taken off" again. Up 26.17% over the past twelve months

May 16, 2025 There's a ton of "Bag Holders" between 5,900 and 6,050 as witnessed by the grey VAP box. That overhead supply will make it rough sledding from here considering the short-term overbought condition. Keep your powder dry for the likely price retracement.

May 8,2025 An old adage..."Never short a dull market" Truer words have never been spoken! Prices have overtaken the VAP band, price resistance at 98,710 and the Upper Warning Line (violet dashed line) of the Schiff Modified Pitchfork (P1 through P3). With a turn is the shorter-term Stochastic Momentum Index and the Fisher Transform. I find it always positive when my Sweet Sixteen Daily Momentum / Breadth Oscillator moves back to "oversold" without serious price destruction. Follow through that carries prices to a 2% break out of resistance and no one can argue! LETS GO!

April 19th, 2025, At the time of our last missive on the shorter-term technical condition of the EEM (highlighted with the yellow circle) prices continued (for weeks) to track sideways in a 3-point range. That was until the following week when prices fell sharply lower below support afforded by the Cloud and VAP support (volume at price) thanks to the “Tariff Bomb”. Two more days of extended price weakness brought about an oversold condition as witnessed by 10-Day Stochastic Momentum and more importantly, my EM Country ETD Daily Momentum / Breadth Oscillator and a sharp price reversal unfolded which led to me to draw the new Standard Pitchfork (violet P1 through P3) and a week ago last Friday, the EEM overtook the Median Line (violet dotted line) of the Pitchfork. That said, with the oversold fuel mostly spent, the rally has stalled at what was once VAP support now turned VAP resistance. It is premature to suggest the nadir was reached at P3. Only a follow through rally that overtakes VAP resistance, massive Cloud resistance and the Upper Parallel (solid violet line) of the Pitchfork would suggest that the correction has run its course. Buyers beware of another “Trump Card” (tip of the hat to Stephen Suttmeier for that one).

April 13, 2025 Excerpt from today's just published Substack Blog, The Market’s Compass Crypto Sweet Sixteen Study... "Last Sunday the CCi30 Index dropped below Median Line (violet dotted line) support of the Schiff Modified Pitchfork (violet P1 through P3) which had dutifully acted as support for the better part of two weeks. On Monday price fell below key price support at the October / November 2024 double bottom and tagged the Lower Parallel (solid violet line) of the Pitchfork but recovered by the end of the day and for all intents and purposes that price support (13,150.00) has held during any intra-day weakness since. The shorter-term Stochastic Momentum Index has made a full turn higher away from oversold territory (green dashed line) but the best thing that can be said about MACD is that it continues to track sideways in negative territory (that’s not much). The Sweet Sixteen Daily Momentum / Breadth Oscillator has left its oversold condition behind and is back above both moving averages. That said, the index is still trapped in the confines of the Schiff Modified Pitchfork below the Kijun Plot (green line) and once again I repeat what I said last week, only a rally above the Kijun Plot and in turn above the Upper Parallel (solid violet line) and the Cloud would suggest that the correction from the December highs may have run its course".

April 11, 2025 Much has been posted about Ethereum's price and Relative underperformance vs Bitcoin. That Relative underperformance is mirrored by it vs. the broader CCi30 Index (lower panel with linear regression highlighted with red dashed line). That said there may be a short-term counter trend rally in the cards. The 10-day Stochastic Momentum Index may have bottomed out when it hooked higher through its signal line (yellow circle) from oversold territory. Overtaking the Median Line of the Schiff Pitchfork and the Kijun Plot (green line) could lead to a challenge of the Upper Parallel. Watch MACD to retake the ground above its signal line as confirmation. Of course, this technical thesis would be void with a break of the Lower Parallel. Be nimble!

April 10, 2025 There is nothing here that suggests that an imminent rally is about to unfold! Quite the opposite.

April 8, 2025 The Total ETF Technical Ranking (“TER”) Indicator is a total of all 30 ETF rankings and can be looked at as a confirmation/divergence indicator as well as an overbought oversold indicator. As an overbought/oversold indicator: The closer the TER gets to the 1500 level (all 30 ETFs having a TR of 50) “things can’t get much better technically” and a growing number of individual ETFs have become “stretched” the more of a chance of a pullback in the SPX Index. On the flip side the closer to an extreme low “things can’t get much worse technically” and a growing number of ETFs are “washed out technically” an oversold rally or measurable low is close to be in place. Last week the TER reached an extreme low (274) suggesting at the very least a counter trend rally (likely a 4th wave) will develop in the days to come.

February 10th, What follows is an excerpt from this morning's Market's Compass US Index and Sector ETF Study... "After a spirted rally three weeks ago that drove the large cap index back above the Daily Cloud to new highs, the SPX has churned higher but the Index did manage to rise above the Upper Parallel (solid gold line) of the falling Standard Pitchfork (P1 through P3) that I applied after the price pivot high at P3 but has not been able to stay above it and is back in the confines of the Pitchfork. That said, the Kijun Plot and the Daily Cloud have managed to offer a good deal of price support the past two weeks. MACD reflects the sideways price churn as it tracks sideways above its signal line in positive territory. My SPX Daily Momentum / Breadth Oscillator continues to fall from the overbought non-confirming high in January and is back below its longer-term 45-Day EMA. Only a rally and close above the sliding parallel (gold dashed line) would suggest the backing and filling may have run its course. Key support is at the 5,950 level. To receive the weekly ETF Studies and Market's Compass Sweet Sixteen sent to your e-mail become a paid subsciber at... https://themarketscompass.substack.com

February 3rd Aside from being great fodder for the financial media (tariffs) all thats happened technically is that the large cap index traded down into the middle of the four month trading range and has since recovered nearly half its loss. There is still an underlying bid despite a loss of upside momentum.

January 31st Above is an excerpt from today's Market's Compass Blog, Engineering News Record Construction Costs that focuses on select Aggregate Prices... The ENR 20-City Average Price of Masonry Sand has continued to rise at a startling rate and is now up 56.18% year-over-year. More dramatic is the rise over the past five years, since January 2019, up 231.13%. To become a subscriber go to... https://themarketscompass.substack.com

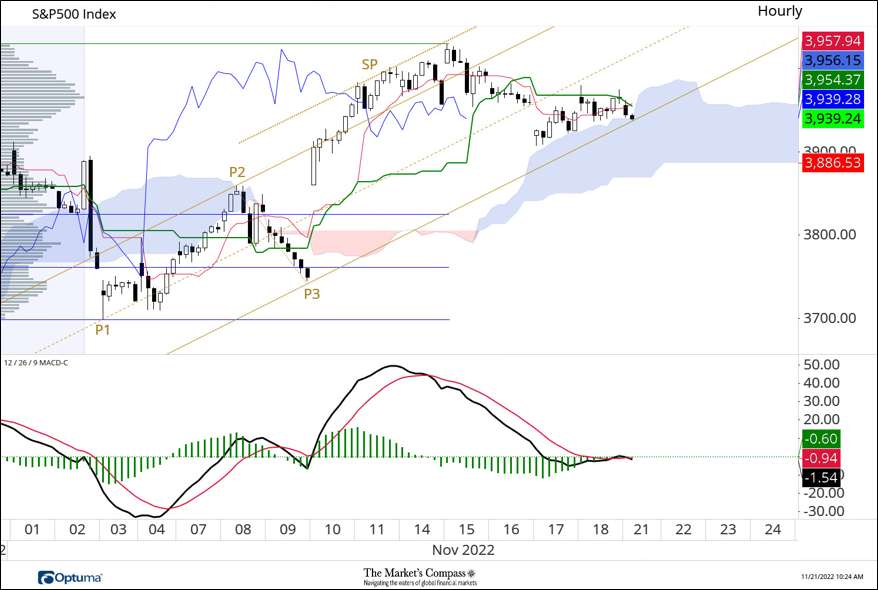

December 12th, Follow Up,,,The cash SPX 500 Index rallied yesterday as the futures suggested it would, but the cash index failed to rise above the first technical hurdle (Upper Parallel, solid red line, of the newly drawn Standard Pitchfork, red P1 through P3. That, as I said yesterday, a rally above that level and the Sliding Parallel (gold dashed line) of the Schiff Pitchfork (gold P1 through P3) would suggest that the current price pullback was of a minute degree. During the first two hours of trading today prices continue to be capped at the Upper Parallel of the shorter-term Pitchfork. My Momentum/Breadth Oscillator has reached an oversold level that has led to meaningful rallies in the past. For that reason, I place the odds of an advance though the Upper Parallel and an attempt to challenge resistance at the Sliding Parallel after Tuesday’s low as a high probability.

December 11, Late last week the S&P 500 Index rolled over from a new closing high and by some measures it was in concert with a short-term overbought condition and yesterday the large-cap index traded and closed just below the Upper Parallel (solid gold line) of the Schiff Pitchfork (gold P1 through P3). Last week's price pivot gave birth to a shorter-term Standard Pitchfork (red P1 through P3) which will guide us to the potential depth of the developing price retracement. On another technical note that price pivot terminated at a level that defined a clear Sliding Parallel*. Both momentum oscillators have rolled over, but I caution that my Momentum/Breadth Oscillator has reached a level associated with price rebounds which futures prices suggest will unfold today. Only a rally above the Upper Parallel of the Standard Pitchfork (solid red line) and the Sliding Parallel (gold SP) would suggest that the current price pullback is of a minute degree and not the same ilk as the November price pullback from red P1.

November 22, Over the past two weeks both Stellar (XLM) and Ripple (XRP) have exhibited noteworthy Relative Strength and Relative Strength Momentum (note the distance between the daily nodes) as they left the Lagging Quadrant behind and rose through the Improving Quadrant into the Leading Quadrant. Daily Candlestick Charts of both are posted below and as will be seen later in this week’s Study both registered huge absolute price gains. Cardano (ADA) was rising in the Leading Quadrant until it began to lose Relative Strength Momentum last week. Nonetheless it remains in the Leading Quadrant displaying positive Relative Strength vs. the broader crypto market. Dogecoin (DOGE) was rising in the Leading Quadrant two weeks ago but rolled over at the start of last week and started to quickly lose upside Relative Strength Momentum and at the end of last week it fell into the Weakening Quadrant. Tron (TRX) hooked higher at the start of last week and has edged into the Improving Quadrant.

November 21, Why Median Line Analysis? Here's why! The Upper Parallel (solid violet line) capped the post-election rally. Hardly a surprise, note the overbought signal in the oscillators. Price is now teetering on the Median Line (dotted violet line) of the Schiff Modified Pitchfork. Watch key support at the Kijun and Tenkan Plot (green and red lines) at 5,855.00, a break of which would target the Lower Parallel and Cloud support.

November 3, The Average Technical Ranking of the 21 Developed Markets Country ETFs charted with the Weekly Cloud Chart

The Weekly Average DM Technical Ranking (“ATR”) is the average of the individual Technical Rankings of the 21 Developed Markets Country ETFs we track. Like the TER, it is a confirmation/divergence or overbought/oversold indicator.

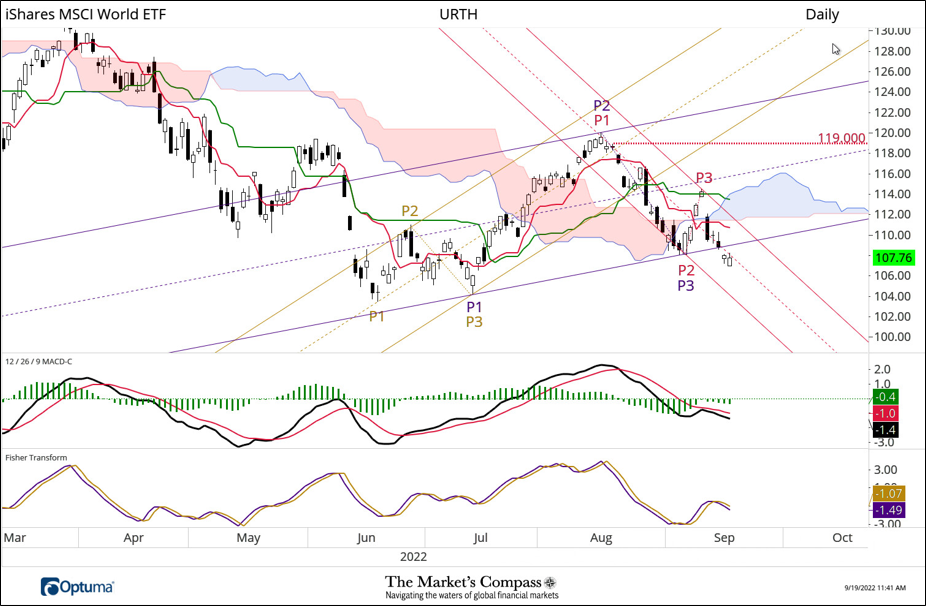

The URTH rolled over the past three weeks before mounting a full challenge of the Upper Parallel (solid gold line) of the Standard Pitchfork (gold P1 through P3). I chose that variation of Pitchfork and have continued to utilize it for two reasons. One has been the respect that prices have paid to both the Median Line (gold dotted line) and resistance offered by the Upper Parallel (solid gold line). Secondly the angle of the climbing Pitchfork mirrors the vector or angle of the rising Cloud. The Average Technical Ranking or ATR confirmed the new closing price recovery three weeks ago but has since rolled over and is back below both the 45-Week and 9-Week moving averages. That said the ATR is currently in neutral territory. One positive technical feature is that during the price pullback between price pivot P2 and P3 the Tenkan Plot (red line) fell below the Kijun Plot (green line) but that has not yet happened. Both the Fisher Transform and the Stochastic Momentum Index have fallen below their signal lines. Only a reversal and rally above the recent highs would suggest the short-term pullback has run its course.

October 31st, S&P 500 Index, BOO! The bulls have nothing to hang their hat on in the short term. The S&P 500 Index broke dual support at the Kijun Plot and the Lower Parallel of the Pitchfork today. The secondary momentum indicators continue to track lower. Next support may be found at the previous ST distribution pattern low at 5,674 but cloud support beckons like Dracula's eyes. "Come to me my child".

October 28, 2024, At the time of our last published Emerging Markets Country ETF Study on October 7th the EEM was taking a third “shot” at overtaking the Upper Warning Line (violet dashed line marked UWL) which I have highlighted with a yellow circle. That third attempt failed, and prices have pulled back since, breaking back below the Upper Parallel (solid violet line) of the Schiff Pitchfork (violet P1 through P3). The EEM violated support at the Kijun Plot (green line that marks the midpoint between the lowest low and highest high over the past twenty-six trading sessions) and is teetering on Median Line support (violet dotted line). Another feature that leaves me cautious is that the Tenkan Plot (red line) is about to cross below the Kijun Plot which often suggests lower prices are in the cards. There is nary a hint that the downside price momentum is subsiding. Although MACD remains in positive territory it continues to track lower below its signal line as does the Stochastic Momentum Index. The only technical feature that suggests a short-term price bounce may be in the cards is that my EM Country ETF Daily Momentum / Breadth Oscillator is beginning to probe oversold territory (lower panel) but it remains trapped below the longer-term 45-Day Moving Average (blue line) and is again below the shorter-term 9-Day Moving Average (red line). If Median Line support is violated prices will target the Lower Parallel (lower solid violet line) in and around the 44.00 level

October 26, 2024, Dogecoin (DOGE) continued to exhibit extraordinary Relative Strength and Relative Strength Momentum throughout last week (following through on the previous gains) until last Thursday when DOGE began to roll over. Since rolling over the previous week, Uniswap (UNI) accelerated lower losing Relative Strength Momentum as it fell sharply out of the Leading Quadrant into the Weakening Quadrant coming to rest just inside the Lagging Quadrant at the end of last week. After “waffling” back and forth in the Leading Quadrant, Solana (SOL) began to rise in the Leading Quadrant registering better Relative Strength and Momentum. Over the past two weeks Tron (TRON) has registered a “three quadrant move” falling out of the Leading Quadrant, through the Weakening Quadrant and into the Lagging Quadrant. Nonetheless it started to turn higher at the end of last week.

October 20, 2024, Excerpt from tomorrow's Market's Compass Index and Sector ETF Study that will be sent to my paid Substack subscribers in the AM... "The grind higher in the SPX Index continues as it rallies, followed by backing and filling above and below the Median Line (gold dotted line) of the Schiff Modified Pitchfork (gold P1 through P3) but upside price momentum has been anemic as witnessed by MACD, the Stochastic Momentum Index, as well as my Daily Momentum / Breadth Oscillator. I now mark key support at the Kijun Plot (green line) and the Lower Parallel of the Pitchfork (solid gold line) at 5,735.00".

October 19, 2024, Last week the CCi30 Index broke out and closed above Upper Parallel (solid red line) of the Schiff Modified Pitchfork (red P1 through P3) that had contained prices since the P1 pivot high in March. Downside price momentum had been slowing for the past few weeks as evidenced by MACD and the momentum oscillator is challenging its signal line and is about to turn up into positive territory. The “first to turn” Fisher Transform turned up through its signal line five weeks ago from a higher low giving a hint that a price turn was in the cards and at the same time the Stochastic Momentum Index turned back above its signal and began to track higher again. These secondary technical features and the price breakout out of the downtrend suggest the CCi30 Index may be out of the woods for the first time since March.

October 13, 2024, Thoughts on the Short-term Technical Condition of the iShares MSCI World ETF / URTH

Since the price pivot low at P3 and successful test of support offered by the Kijun Plot (green line) prices and for all intents and purposes (despite two brief forays above it) prices have been capped by the Median Line (gold dotted line) of the Schiff Modified Pitchfork (gold P1 through P3) and have been mired between the Median Line and the Lower Parallel (solid gold line) of the Pitchfork. During the price pullback two weeks ago MACD turned lower through its signal line but with last week’s price recovery it set to move back above in concert with the Fisher Transform retaking the ground above its signal line. The Stochastic Momentum has also turned higher from neutral territory. My DM Country ETF Momentum / Breadth Oscillator has turned higher from a near oversold condition. These technical features suggest odds favor a new recovery price high is in the cards.

October 12, 2024, Prices fell into the Daily Cloud two Wednesdays ago. Support at the Lower Span of the Cloud held as support and a brief attempt to retake the round above the Cloud failed and last Thursday the CCi30 Index fell back into the Cloud. All four secondary Indicators continue to drift lower. MACD is entering negative territory, the Fisher Transform is back below its signal line, the Stochastic Momentum Index is tracking sideways, and Short Term KST is tracking lower below it signal line. In sum, there is very little on the Daily Chart for the bulls to “hang their hat on”.

October 7, 2024, Follow up to last Sunday's tweet on the technical condition of the SPX. The Chickens are Coming Home to Roost! Despite the fact prices were climbing support at the Median Line (gold dotted line) of the Schiff Modified Pitchfork (gold P1 through P3), I was concerned that upside price momentum was faltering. On the following Monday prices broke support and have drifted lower since. My Daily Momentum / Breadth Oscillator is not oversold. Watch key support at the Lower Parallel of the Pitchfork and the Kijun Plot (green line) at 5,585.00.

October 7, 2024, "Feet Don't Fail Me Now! Last week Bitcoin held the triple support offered by the Median Line (gold dotted line) of the Schiff Modified Pitchfork (gold P1 through P3), the Kijun Plot (green line that marks the midpoint of the lowest low and highest high over the past 26-days), and Cloud support and with it a rally has begun to blossom. The 8-period Stochastic Momentum Index has turned up through its signal line and MACD is starting to hook higher in concert with a turn in the Fisher Transform. It all adds up to a challenge of the Upper Parallel (solid gold line) of the Pitchfork at the 66,700 / 67,000 level.

October 2, 2024, Digging into recent DXY strength... more than 60% of the DXY is the Euro and Yen. In the case of the Euro, price fell below the Lower Warning Line (gold dashed line) of the Standard Pitchfork (gold P1 through P3) and is testing Cloud support with the momentum oscillators turn sharply lower. In the case of the Yen (higher price = lower yen vs. $) price overtook the Upper Parallel (solid violet line) of the Standard Pitchfork (violet P1 through P3) with a hooking higher in momentum. The US Dollar has likely made an important turn from weakness to recovery.

September 29, 2024, This week's Market's Compass U.S. Index and Sector ETF Study is in the queue and will be sent to my paid Substack subscribers. To become a paid subscriber and read the Study in its entirety go to: https://themarketscompass.substack.com The following is an excerpt... "My good friend and often collaborator, Kyle Crystal, has been known to say, “In price there is truth”. Yes, the price action of any index, stock, ETF or commodity is the guiding factor as to what will likely transpire in the future and in this case makes it difficult to argue with the technical condition of the SPX, but a few secondary technical measures suggest that the large cap index may be ahead of itself. While price has been climbing the “tight rope” of the Median Line (violet dashed line) of the Schiff Pitchfork (violet P1 through P3) which has acted as support over the past seven days, the secondary oscillators suggest a tiring index. Although the SPX marked a new closing high last Thursday MACD did not confirm it and the momentum oscillator is beginning to “flatten out”. The Fisher Transform remains above its signal line, but it is reaching an extreme level that led to a price pullbacks in July and late August. The 10-Day Stochastic Momentum Index has also reached an overbought extreme and is rolling over through its signal line. Lastly, my SPX Daily Momentum / Breadth Oscillator continues in a downtrend (red dashed line) in a developing non-confirming divergence with price. These technical features lead me to question the staying power of the rally even though in price there is truth. After the Median Line, secondary support is at the Kijun Plot (green line) at 5,585".

September 28, 2024, The CCi30 Index has risen for the third week in a row and is once again challenging resistance at the Upper Parallel (solid red line) of the Schiff Modified Pitchfork (red P1 through P3) which has capped rally attempts since the mid-March highs. MACD is starting to hook higher as is the 9-week Stochastic Momentum Index. The Sweet Sixteen Total Technical Ranking has risen the best level since April 15th at 549.5 and the 13-Week Exponential Moving average is starting to turn higher confirming the rally over the past three weeks.

September 24, 2024, When the CCi30 Index overtook the Upper Parallel (solid gold line) of the longer-term Inverse Standard Pitchfork which is drawn from a price pivot high (gold P1) to a price pivot low (gold P2) to price pivot lower high (gold P3) I added a second Standard Pitchfork (violet P1 through P3). Since the violet P3 low prices have walked the “tight rope” of the Lower Parallel (solid violet line). Last Friday the index overtook Cloud resistance at what is commonly referred to as the “twist” (the easiest point for prices to overtake Cloud resistance) and the Kijun Plot (green line). Prices have held Cloud support since then (prices are as of yesterday). All four momentum oscillators suggest the index still has the wind at its back, but it may in the very short-term be a tad extended.

September 15, 2024, On Tuesday the CCi30 Index broke out above the Upper Parallel (solid gold line) of the Standard Pitchfork (gold P1 through P3) that has capped rally attempts since the gold P3 price pivot high. That was a technical achievement but there are two more resistance hurdles ahead. First is the Kijun Plot (green line) which is the mid-point of the highest high and lowest low over the past 26 trading sessions (currently at 12,800) and second is the Cloud model at 13,100. That said, the momentum oscillators suggest that the index has the wind at its back increasing the odds that the 14,375 level will be challenged. Key support is at the Lower Parallel (solid violet line) of the newly drawn Standard Pitchfork (violet P1 through P3) and second is at 11,175.00

September 8, 2024, Last week the S&P 200 Index violated potential support at the Median Line (violet dotted line) of the shorter-term Schiff Modified Pitchfork (violet P1 through P3) and came to rest on the Tenken Plot (solid red line) which marks the mid-point of the highest high and lowest low over, in this case, the past 9 weeks. Key short-term support is now at the Median Line (violet dotted line) of the longer-term Schiff Modified Pitchfork (violet P1 through P3) and the Kijun Plot (solid green line) at the 5,310 level. If that price support is broken, odds favor a test of the Lower Parallel (solid violet line) of the Pitchfork and the price pivot low at violet P3. The US Average Technical Ranking Indicator gave warning of a price reversal by turning at a lower high when price registered a higher high. MACD also cautioned that a turn might be in the cards when it also failed to print a higher high when price did (red dashed line). Last week MACD kissed and rolled over below its signal line.

August 25, 2024, From today’s Market’s Compass Crypto Sweet Sixteen Study…”Avalanche (AVAX) was “waffling back and forth in the Lagging Quadrant until last Tuesday when it exploded to the upside into the Improving Quadrant exhibiting powerful upside Relative Strength Momentum as witnessed by the distance between the nodes. As will be seen later in this week’s study, over the past seven days through Friday, AVAX was up over 30%. Two weeks ago, Cosmos (ATOM) was rising slowly in the Improving Quadrant until it did an about face and fell into the Lagging Quadrant losing Relative Strength and Relative Strength Momentum as it tracked lower although the course of the past week downside Relative Strength Momentum has begun to slow. On a Relative Strength basis vs. the CCi30 Index Uniswap (UNI) has continued to improve as it has moved into the Leading Quadrant but with faltering Momentum. Tron (TRX) rolled over quickly two weeks ago and was falling toward the Weakening Quadrant but avoided entering it when it hooked sharply higher early last week and now it shows improving Relative Strength. Stellar (XLM) began to track lower two weeks ago and then gathered a pace and fell into the Weakening Quadrant last week losing both Relative Strength and Relative Strength Momentum”. More on RRG Charts…https://www.optuma.com/videos/introduction-to-rrg/

August 22, 2024, Looks to me like the CCi30 Index is getting ready "to go"! A turn in all four measures price momentum have turned up including Pring's Short-term KST (bottom panel) which is the sum of four simple moving averages of four different rate-of-change (ROC) periods, to come up with the KST, and creating a signal line by taking the 9-period SMA of the KST. A move and close above 13,425.00 would likely lead to a test of potential resistance at the Upper Parallel (solid gold line) of the Standard Pitchfork (P1 through P3). Above there, the twist in the Cloud should be an easy hurdle to surpass.

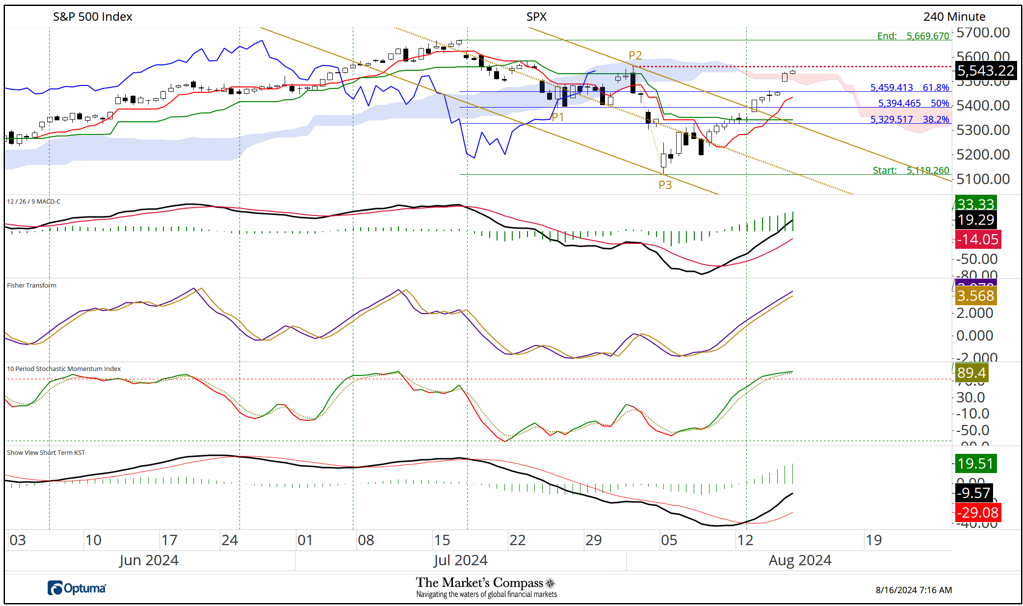

August 18, 2024, This week's Market's Compass U.S. Index and Sector Study will be sent to my paid Substack Subscribers in the AM tomorrow. To become a free or paid subscriber go to https://themarketscompass.substack.com The following is an excerpt... "There are several technical features on the Daily Candlestick / Cloud Chart that suggest that rally from the August 5th lows is not simply a counter trend move (or at least the odds have been greatly reduced). A week ago, last Thursday, I added a new Standard Pitchfork (gold P1 through P3) to the daily chart. The following day the SPX overtook and closed above the Median Line (gold dotted line) of that Pitchfork. Last week two more technical hurdles were surpassed when last Tuesday, the large cap index traded and closed above the Kijun Plot and on Thursday the index retook the ground above Cloud resistance. The follow day prices were challenging potential price resistance at the P2 price pivot at 5,565. Not only has MACD turned off its lows it has done so with “gusto” and is tracking above its signal line and is one good day away from re-entering positive territory. My Daily Momentum / Breadth Oscillator has also turned sharply higher breaking out of the down trend (yellow line) and is back above both moving averages. All of the above suggest at the very least the July highs will be challenged".

August 16, 2024, Although it is becoming less and less likely due to the improving technical condition there remains the possibility that what we have witnessed since the August 5th low at gold P3 is a “B’” Wave of a larger 4TH Wave correction of an Elliott Wave A-B-C flat correction. Unless they begin to slow and roll over the condition of the momentum oscillators below the price chart places the odds of that Elliott count at very low.

August 14, 2024, #SPX The rally from the August 5th low at price pivot P3 has extended farther than I thought it would and it has overtaken two hurdles of note. On Tuesday prices traded and closed above both the Kijun Plot (green line) and the Upper Parallel (solid red line) of the longer-term Standard Pitchfork (red P1 through P3) and yesterday the large cap index was challenging previously broken TDST Support and Cloud resistance. The next level to watch is the Upper Parallel (solid gold line) of the newly drawn Standard Pitchfork (gold P1 through P3). Both MACD and the 10-Day Stochastic Momentum Index suggest that there is enough positive price momentum that those levels will be overtaken and if so the odds that this is only a counter trend rally will have greatly diminished. In Price there is Truth.

August 11, 2024, Two Wednesdays ago, the URTH fell below both the previously overtaken Upper Warning Like (solid gold line) of the Schiff Modified Pitchfork (gold P1 through P3) and the Kijun Plot (green line that marks the mid-point of the highest high and lowest low over the past 26 days). An attempt to retake the ground above the Upper Parallel and the Kijun Plot failed two weeks ago, and the decline resumed when the Median Line (gold dotted line), Cloud support and the Lower Parallel (lower solid gold line) were all violated. The sharp decline drove my DM Country ETF Daily Momentum / Breadth Oscillator to an oversold extreme (lower panel) and a counter trend rally unfolded last week. Monday’s price pivot led me to draw a new short-term Schiff Pitchfork (red P1 through P3) that helps identify the vector of last week’s rally. MACD’s descent has begun to slow but the oscillator remains below its signal line in negative territory. Formidable and multiple price resistance at the Median Line (gold dotted line) of the longer-term Schiff Modified Pitchfork, the Upper Parallel (red solid line) of the Schiff Pitchfork, the previously broken Kijun Plot, and price resistance (highlighted with the yellow circle) lay directly ahead. Only if these hurdles are overcome would I be able to say that the URTH might be out of the woods.

August 10, 2024, This week's Market's Compass Crypto Sweet Sixteen Study is in the queque and will be sent to my Paid subscribers in the AM.

Come on Crypto Dudettes and Dudes step up and become a paid subscriber... https://themarketscompass.substack.com

Not all sixteen cryptocurrencies are plotted in this RRG Chart. I have done this for clarity purposes. Those which I believe are of higher technical interest remain.

The following is an excerpt "Dogecoin (DOGE) had begun to fall sharply in the Leading Quadrant two weeks ago. Last week it continued to fall in the Weakening Quadrant and at the end of the week it moved into the Lagging Quadrant. Solana (SOL) started last week with accelerating downside Relative Strength Momentum but as the week progressed its descent began to slow and turn but nonetheless it remains in the Weakening Quadrant. Polkadot (DOT) has risen out of the Lagging Quadrant and has moved into the Improving Quadrant. That said, it needs to improve more on a Relative Strength basis to suggest it is entering the “sweet spot”. Both Tron (TRX) and Stellar (XLM) moved into the Leading Quadrant last week".

August 8, 2024, Gold prices held key support at the Median Line (red dotted line) of the Schiff Pitchfork (red P1 through P3) on an intra-day basis during Monday’s rout and prices have continued to hold that key support since, as well as the shorter-term Standard Pitchfork (violet P1 through P3) Lower Parallel (solid violet line). Granted there has been a short-term stalling of upside price momentum during the price pullback but not a reversal. Odds favor that the pullback from the Upper Parallel (solid red line) that capped the rally from the violet P3 pivot will again be challenged, evidenced by today’s strong reversal and advance. As I am fond of saying, "This is not a guess, only a calculated deduction".

August 7, 2024, After being up early yesterday, the S&P 500 Index closed off -40.51 points or -0.77%. The 38.2% retracement of the selloff from the July highs capped today’s continuation of the counter trend rally. Is that all she wrote? IMO it very well could be. I was expecting an Elliott Wave 4 rally, but I declined to try and catch the counter trend move. MACD is still tracking lower and Stochastic Momentum Oscillator has moved back below its signal line. Today’s price action could be “B” of “4” but any move that takes out today’s high will have plenty of resistance, first at the Kijun Plot (green Line), second at the 50% retrace level and further above, the Upper Parallel of the Pitchfork (solid gold line).

August 4, 2024, When I last shared my thoughts on the short-term technical condition of the EEM (yellow circle) i shared my concern “that the EM Country ETF Daily Momentum / Breadth Oscillator is reaching an overbought extreme. That said, a measure of backing and filling is likely in order”. What has unfolded has been more than just backing and filling. Prices first broke support at the Median Line (violet line) of the Standard Pitchfork (violet P1 through P3) and potential support at the Kijun Plot the following week. Next to give way was support at the Lower Parallel (solid violet line). An attempt to recover failed at previous broken support and the decline continued and on Friday the EEM fell and closed below Cloud support. MACD, which never confirmed the July 12th high, is tracking lower below its signal line in negative territory without a hint of a turn in downside momentum. The Fisher Transform briefly turned from an extreme low but is rolling over again. The Em Country ETF Daily Momentum / Breadth Oscillator which reached an overbought extreme in early July quickly moved lower withe the selloff in price and tried to recover but the longer-term moving average (blue line) but a lid on the move. The only potential positive thing that can be said is that the shorter-term moving average (red line) has reached a level that suggests a low in price may soon be in the cards, but the moving average needs to stop declining for that to be a potential positive. If the Median Line (gold dashed line) of the shorter-term Pitchfork (gold P1 through P3) is violated lower levels can be expected.

July 31, 2024, Gold Front Month Futures Contract…There is more than a good measure of technical evidence that today’s rally in Gold will follow through to new highs. After overtaking the Median Line (red dotted line) of the medium-term Standard Pitchfork (red P1 though P3) on Tuesday (that had contained prices since the April highs) today prices overtook the Median Line (violet dotted line) of the short-term Standard Pitchfork (violet P1 through P3) that has identified the vector of the rally from the July 27th low (violet P1). Gold has the wind at its back as evidenced by the momentum oscillators and the Fisher Transform as well as the impulsive rally over the past two days.

July 28, 2024, Next week's U.S. Index and Sector ETF Study is in the queque and will be sent to my paid subscribers tomorrow in the AM. Consider becoming a paid subscriber... https://themarketscompass.substack.com The following is an excerpt... "Three Friday’s ago, on July 5th, the SPX Index overtook resistance at the Upper Warning Line (red dashed line marked UWL) of the Schiff Pitchfork (red P1 through P3). The rally followed through till it was capped at the second Warning Line (red dashed line marked UWL2). There was little question that the large cap index had become stretched and a week ago last Wednesday a counter trend move began to unfold and last week prices fell back below the previously overtaken Upper Parallel (solid red line) and the Median Line (red dotted line) as well as the Kijun Plot (green line), before last Friday’s rally. There is nary a hint in MACD that the pullback has run its course. My Daily Momentum / Breadth Oscillator turned up on Friday, but the 9-Day Moving Average of the indicator (red line) is still falling. First resistance is at the previously broken Upper Parallel and the Kijun Plot (green line) at 5,230.00. Odds favor that support at the Lower Parallel (lower solid red line) and the Upper Span of the Cloud will be tested".

July 24, 2024, Don't let anyone tell you "Stick your toe in the water" (at the index level), your likely to encounter a shark! Today's break of, at first the Kijun Support (green line), and close below key TDST support at 5,445 and the Median Line (gold dotted line) of the longer-term Schiff Pitchfork (P1 through P3) speaks to a test of Cloud support and the Lower Parallel (solid gold line) of the same Pitchfork. The odds favor that it will likely lead to a test of secondary support at the Lower Parallel (solid gold line) at 5,260. Key your powder dry!

July 24, 2024, Last Friday I suggested "There is little question in my mind that a correction of a larger degree is developing than we have seen since the April lows in the NDX, with a break of three key support levels over the past two days. I believe before it’s over, that the Lower Parallel (solid red line highlighted with the yellow circle) will at the very least be tested". That is what has unfolded. That said I am not prepared to say that the NDX has reached its nadir. That said, considering the condition of MACD and the Fisher Transform key secondary support afforded by TDST support at the 18,775 level, the 50% retracement level and the Cloud will more than likely will be tested before a measurable counter trend move will develop.

July 14, 2024, The Daily Line Chart of Sweet Sixteen Index is exhibiting a few technical features that suggest that the Sweet Sixteen Index and Crypto Currencies are moving towards, at the very least, a temporary recovery rally. Despite breaking the Lower Parallel (solid gold line) of the Schiff Pitchfork (gold P1 through P3) early this month, MACD did not print a lower low and the momentum oscillator has just turned up through its signal line in concert with the Fisher Transform turning up through its signal line at a higher high. The Sweet Sixteen / Momentum / Breadth Oscillator has avoided a lower low when prices did and is back above 9-Period Moving Average and is poised to overtake its longer-term moving average. These technical factors suggest that odds favor a move up to first resistance at the Median Line (gold dotted line) and possibly previously broken price support at the 11.00 level.

July 11, 2024, Gold Follow up…..After being capped at 1st resistance at 2,395 the pullback held support at the Kijun Plot (green line) early this week and this morning Gold plowed through 1st resistance and is targeting the May 20th price pivot high at 2,455!

July 7, 2024 After holding support at the Median line (gold dotted line) of the Standard Pitchfork (gold P1 through P3) in May and June (highlighted with green arrows) the front month Gold Futures Contract broke out above the Upper Parllel (solid gold line) and Cloud resistance on Wednesday which had capped rally attempts last month. The rally extended last Friday, closing the session just above first resistance at the 2,395 level. MACD is back above its signal line and has just reentered positive territory. These technical features suggest to me that gold is poised to revisit the May highs

June 31, 2024, This week's Market's Compass Developed Markets Country ETF Study is in the hopper and will be sent to my Substack Blog subscribers in the AM. To subscribe go toand become a paid subscriber at a mere pitance.

https://themarketscompass.substack.com

What follows is an excerpt... "The Total Technical ETF Ranking (“TER”) Indicator is a total of all 22 ETF rankings and can be looked at as a confirmation/divergence indicator as well as an overbought oversold indicator. As a confirmation/divergence tool: If the broader market as measured by the iShares MSCI World Index ETF (URTH) continues to rally without a commensurate move or higher move in the TER the continued rally in the URTH becomes increasingly in jeopardy. Conversely, if the URTH continues to print lower lows and there is little change or a building improvement in the TER a positive divergence is registered".

"The URTH notched a new weekly closing high of 147.49 at the end of last week. The move higher to that level cannot be consider impulsive but just a grind higher since the May 17th high of 146.73 in a series of nominal new highs followed by backing and filling. Since reaching a confirming high in the DM Total Technical Ranking in the middle of May at 862 the TER has fallen for six weeks in a row failing to confirm last weeks new closing high. Confirming the down trend in the TER has been the 13-Week Moving Average (red line) which continues to track lower establishing a new short-term lower low. The TER ended last week in the lower half of its nearly eight-year range, ending the week at its lowest level since November of last year".

June 30, 2024, Despite losing a measure of Relative Strength Momentum, Tron (TRX) continues to improve of a Relative Strength basis versus the CCi30 Index. Over the course of last week Ripple (XRP) also lost Relative Strength Momentum and although it still exhibits positive Relative Strength it trails TRX. Bitcoin (BTC) and Uniswap (UNI) fell out of the Leading Quadrant into the Weakening Quadrant last week. UNI lost Relative Strength Momentum at a much higher rate as can be seen by the length of the tail. Polkadot (DOT) and Cosmos (ATOM) have reversed course and are moving higher in the Improving Quadrant.

Please note: Not all sixteen cryptocurrencies are plotted in this RRG Chart. I have done this for clarity purposes. Those which I believe are of higher technical interest remain.

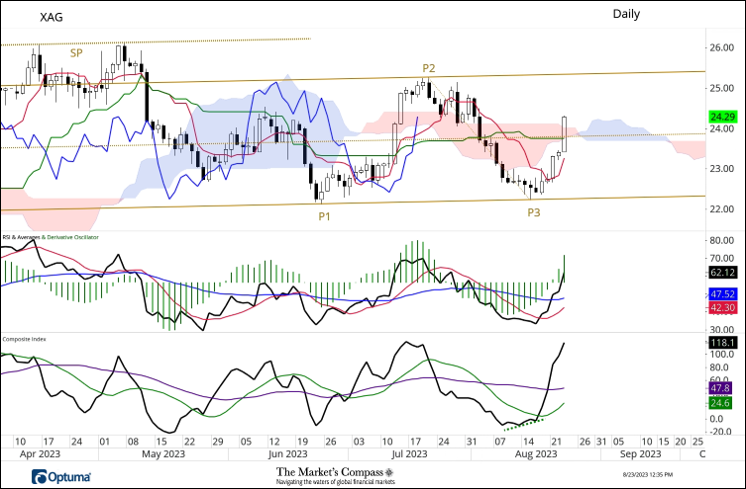

June 20, 2024, It may be premature to declare the three-week corrective phase in Silver has run its course by there are early signs that it may have reached its terminus. Key support at the $29 held last week and early this week and prices have started to move higher and are challenging the down trend line (yellow dotted line). Prices also avoided a test of Cloud support. What I consider as the “first mover”, Fisher Transform has started to hook higher, from an extreme low and has overtaken its signal line. MACD has thus far avoided entering negative territory and is stabilizing in concert with the histogram (vertical green lines) pushing higher. Key to the thesis that the short-term correction is complete is Silver’s ability to close above downtrend resistance and its ability to overtake and close above the Kijun Span (solid green line) which is the midpoint between the highest high and lowest low over past 26 trading sessions. I may be sticking my neck out, but I believe odds favor that the three-week corrective phase has indeed run its course.

June 19, 2024, After bottoming on June 4th (red P3), the rally extended, and a week ago last Monday, Crude Oil Futures impulsively overtook resistance at both the Median Line (red dotted line) of the newly drawn Standard Pitchfork (red P1 through P3) and the Kijun Plot which had capped rally attempts since falling below it in mid-April (highlighted with the yellow circle). On Monday Oil powered out of the down trend that has been in place since early April (yellow dotted line). Prices rallied above the Upper Parallel of the of the Standard Pitchfork (solid red line) and closed above it yesterday. Cloud resistance and the April distributive top are now coming into play. That said, oil has the wind at its back as witnessed by MACD but one should keep an eye on the Fisher Transform which is reaching the upper boundary of its range although it continues to track higher and remains above its signal line. All the technical features mentioned above suggest that an important price pivot on June 4th (red P3) marked a key turn in oil prices but a measure of “backing and filling” is likely in order before oil can extend the rally. A rally through Cloud resistance at the $82 level would place April highs in the bulls’ crosshairs. The technical condition of Crude Oil Futures will be a regular feature in the upcoming Market’s Compass Speculator which will be published to my Substack Blog fortnightly.

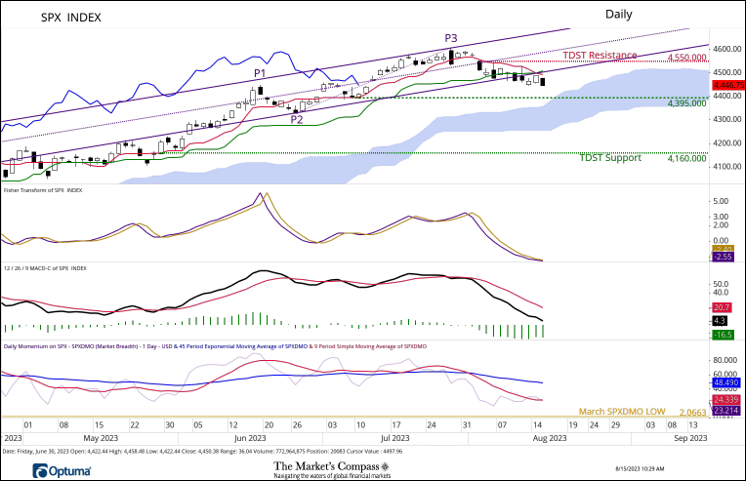

June 16, 2024, The SPX Index overtook resistance and closed firmly above the longer-term Schiff Modified Pitchfork’s (violet P1 through P3) Upper Parallel (solid violet line) early last week. On Wednesday prices gapped higher at the open and overtook the shorter-term Schiff Modified Pitchfork’s (red P1 through P3) Upper Parallel (solid red line) and held above it over the balance of the week. The new price highs have not yet been confirmed by MACD but appear to be on the verge of doings so. That said the SPX Momentum / Breadth Oscillator (bottom panel is another niggling technical concern as was the TER and ATR discussed earlier in this weeks Blog. Despite the new price highs, it remains trapped below the longer-term 45-day exponential moving average and last week it dropped below the 9-day simple moving average. The oscillator has notched a new low for the month. This will become an issue if the rally is not able to broaden out over the coming trading sessions.

June 13, 2024, Considering the fact that the S&P 500 Index and the Nasdaq 100 have both registered new all-time highs over the past two trading sessions, I find it hard to believe that anyone would be willing to step into the small cap arena considering the technical condition of the Russell 2000 in the chart below. If Cloud support and the Median Line (gold dotted line) give way prices could easily revisit the Lower Parallel (solid gold line).

June 8, 2024, Binance (BNB) ended the week up +15.24%, breaking out of the 2 1/2-month sideways triangulating price pattern. It would have been up more if it hadn’t pulled back on Friday from its all-time intra-day high of 721.17 marked on Thursday. Nonetheless, Friday’s close (683.67) was the highest weekly closing high since Binance’s debut in 2017. MACD did not confirm the new highs, but it did not fall below its signal which it “kissed” and is starting to hook higher in concert with a turn in the Fisher Transform. The Technical Ranking (TR) held support at the 45-week exponential moving average (blue line) and last week the TR retook the ground above the shorter-term 9-period moving average (red line). It’s hard to argue with the technicals mentioned above but a price pullback to the breakout level (625-635) would hardly be a surprise

May 28, 2024, In early May when the SPX Index regained the ground above the Daily Cloud Chart, I applied a Schiff Modified Pitchfork (violet P1 through P3). Since a week ago last Wednesday prices have been capped by the Upper Parallel (solid violet line) of that pitchfork. Last Thursday the index produced a nasty outside day or in candle parlance an engulfing candle but thus far it has not unfolded into a full-fledged reversal. What has developed has been a sharp turn in my US ETF Daily Momentum / Breadth indicator which has fallen sharply despite prices holding near to the recent highs. MACD has also not confirmed the recent price highs and is beginning to roll over. I believe that odds favor a degree of backing and filling that will drive prices to key short-term support at the Median Line (violet dotted line) of the pitchfork, the Kijun Plot (green line) and the Cloud at the 5,150/5,175 level.

May 22, 2024 CCi30 Index* breaks out of the trading range “box” on Monday, holds Cloud support yesterday. Short-term measured move target 19,000.

*The CCi30 Index is a registered trademark and was created and is maintained by an independent team of mathematicians, quants and fund managers lead by Igor Rivin. It is a rules-based index designed to objectively measure the overall growth, daily and long-term movement of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding stable coins (more details can be found at CCi30.com).

May 20, 2024 Last Wednesday Bitcoin over took the Sliding Parallel (gold SP) of the Schiff Modified Pitchfork (P1 through P3). On Friday it overtook Cloud resistance at the twist. After holding Cloud support Bitcoin has exploded higher leaving with improving price momentum as witnessed by MACD. There is little question that the previous corrective price action has run its course.

May 14, 2024 The April pullback in the price of silver has run its course (overtaking the confines of the green price channel). When it broke out of the price channel, I added the Standard Pitchfork (gold P1 through P3). Prices have held above the Lower Parallel (solid gold line) since then. Both the Fisher Transform and MACD suggest that price resistance at the 29 level that has capped prices since mid-April will be overtaken placing the Median Line (gold dashed line) at the 31-31.25 area in the cross hairs of the silver bulls, of which I am one

October 29, 2023, iShares MSCI World Index ETF. Several potential technical support levels on the daily candle chart of the URTH have given way to the downside over the past two weeks. A week ago, last Wednesday the URTH broke below support at the Median Line (purple dotted line) of the Schiff Modified Pitchfork (purple P1 through P3). Over the next two trading sessions the URTH extended its losses giving birth to a second shorter-term Standard Pitchfork (gold P1 through P3). Last Thursday the URTH broke support at the Median Line of that Pitchfork and on Friday the URTH closed at a new 7-month low at 115.01. MACD and the “first turn” Fisher Transform continue to track lower. My Developed Markets Country ETF daily Momentum / Breadth Oscillator has reached a level that has led to counter trend rallies in the past, but I need a firmer reversal signal to declare that is about to happen despite the oversold conditions reflected on the weekly charts before I will stick my neck out.

October 18, 2023 S&P 500 Equal Weight Index. Only a short term pause in the counter trend rally. The Upper Parallel (solid purple line) of the Schiff Pitchfork (purple P1 through P3), price resistance at the 5,825 level and the Kijun Plot (green line) has capped the rally from the Oct. 6th P3 low. The Schiff Pitchfork has thus far contained the three-wave decline from the July high. The very short-term price pattern strikes me as accumulation fortifying an underlying bid. I believe that with the recent positive price momentum as witnessed by MACD and the turn in the Fisher Transform that odds favor that the current counter trend rally has legs. That said we are closely watching key short-term support at the 5,695 level and the P3 low (5,575), a break of which would negate my technical thesis.

September 29,2023 As prices made their way lower to the confluence of support offered by the Lower Parallel (solid purple line) of the Schiff Modified Pitchfork (purple P1 through P3) and the level at which Wave C would equal Wave A the MC Daily Momentum / Breadth Oscillator reach the oversold band and a rally unfolded in concert with the full moon. That shift in price Momentum has driven the Oscillator back above the shorter- term moving average. I am not surprised that counter-trend price move stalled this morning at previous support which has now turned into short-term resistance. I still believe that odds favor an initial challenge of the Median Line (purple dotted line) of the Pitchfork and potentially the Kijun Plot (green line) at 4,390 which is the midpoint between the highest high and lowest low over the past 26 days.

September 23, 2023 After breaking Clould support in the middle of last month Link found price support at the 5.75 level and has rallied over the past two weeks. When prices returned to the Cloud I drew the new Schiff Modified Pitchfork (gold P1 through P3). That variation of Pitchfork marks the price vector better than the Standard or Schiff Variation. LINK is currently challenging resistance at the top of the Cloud. MACD and the Fisher Transform both suggest that there are better than even odds that prices will advance above the Cloud and will make a run at the Median Line (gold dotted line). The lower panel in the chart reflects the improving relative strength vs. the CCi30 Index as it does in the RRG chart that follows.

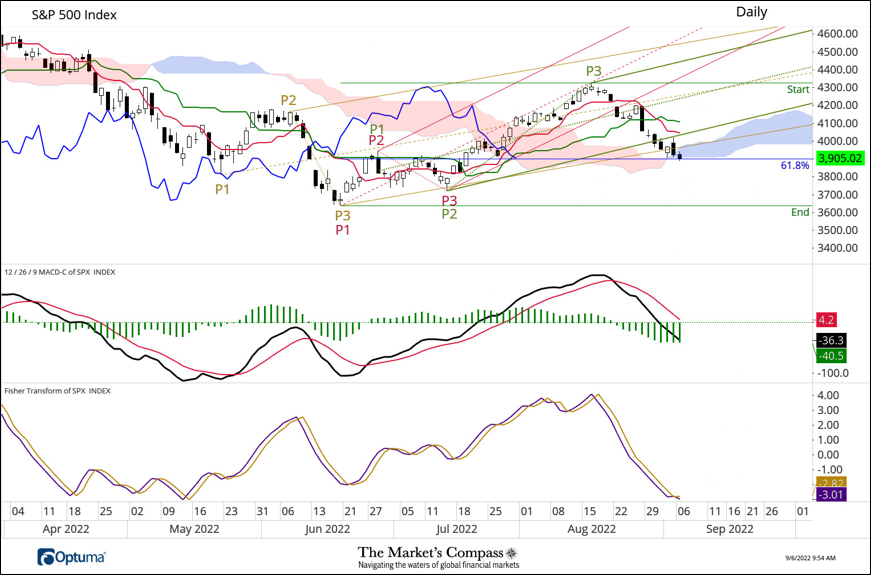

September 22, 2023 I continue to be of the technical opinion that lower prices are ahead of us. The prices action from the late July highs strikes me as a developing Elliott Wave A-B-C decline. Both of Pring’s multi-time frame momentum and trend oscillators suggest that lower prices are in the cards. I believe that at the very least that support at the Lower Parallel (solid gold line) of the Schiff Modified Pitchfork (gold P1 through P3) will be tested.

September 19, 2023 S&P 500 Index, Support at the Kijun Plot (green dotted line that marks the mid-point of the highest high and lowest low over the past 26 days) and the Lower Parallel (solid gold line) of the Standard Pitchfork (gold P1 through P3) gave way this morning. This leaves the Median Line (purple dotted line) of the shorter-term Schiff Modified Pitchfork (purple P1 through P3) and the lower Cloud Span as the next potential support level (highlighted with yellow circle). The Daily Momentum / Breadth Oscillator confirms the move lower as does MACD. Only a recovery rally before the close of trading would alter my technical thesis that lower prices in the large cap index can be expected.

September 15, 2023 There is technically nothing that suggests that multi-month downtrend in the Japanese Yen has run its course. Prices have remained firmly in the confines of Schiff Modified Pitchfork (gold P1 through P3). The secondary technical indicators applied to the chart below actually supports the thesis that price resistance at the 148.85 will only be a temporary roadblock. The Fisher Transform is tracking higher above it signal line as is Pring’s Special K. For those unfamiliar with Special K, it combines short, intermediate and longer-term momentum into one complete series. That said, we are keeping an eye on Median Line support (gold dotted line). If that support is violated then there may be some backing and filling in the cards but that would not change my longer-term technical thesis.

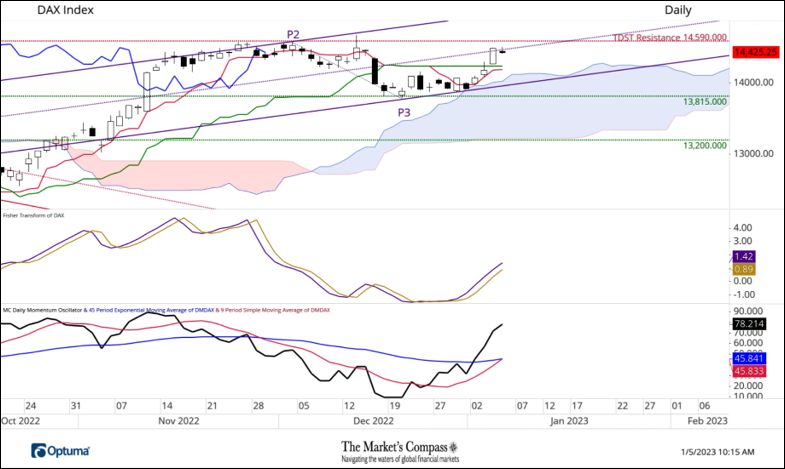

September 12, 2023 Since the initial price downdraft in the DAX Index from late July price pivot high (purple P3) that broke support at the Median line (purple dotted line) of the Schiff Modified Pitchfork (purple P1 through P3) and the break of Cloud support at “the twist” in the Cloud the DAX has been trading sideways beneath the Cloud but for all intents and purposes support at the Lower Parallel (solid purple line) has acted a support. The lack of price momentum in either direction as witnessed by MACD and a near neutral reading in my Daily Momentum / Breadth Oscillator leaves nary a clue as to how the current stasis will be resolved. Only a breakout of the 1 ½ month trading range will indicate resolution. My bet is that the trading range is a continuation pattern that will be followed by lower prices.

September 9, 2023 Aside from the intra week short squeeze higher two weeks ago there has been very little of technical note in the CCi30 Index over the past three weeks. Trading volume has been muted since prices broke lower in the middle of last month. MACD reflects the lack of momentum in either direction. The index remains trapped below the Lower Warning Line (gold dashed line) of the Schiff Modified Pitchfork (gold P1-P3) and key price support at the 6,580 level. There has very little movement in the Sweet Sixteen Total Technical Ranking (SSTTR) although it moved higher last week by +28.74% to 215 from 167. Although the 13-Week Exponential Moving Average of the SSTTR continues to track lower, I feel compelled to remind readers of the old adage, “never short a dull market”.

September 5, 2023 Two weeks ago, the selloff in the EEM found support at the Lower Warning Line (gold dashed line labeled LWL) of the Schiff Pitchfork (gold P1-P3) and short-term rally unfolded. It was not a surprise that the Lower Warning Line held as support as it was in concert with my EM Country ETF Daily Momentum / Breadth Oscillator reaching a deeply oversold condition. That oversold level led to a rally in March as well. That price pivot gave birth to the new shorter-term Schiff Modified Pitchfork (purple P1-P3). For all intents and purposes, thus far the rally has stalled at the underside of the Schiff Pitchfork (solid gold line), the Median Line of the Schiff Modified Pitchfork (purple dashed line) and the bottom of the Cloud. Additional resistance will be found at the Kijun Plot (green line) at 40.10. The Kijun Plot is the mid-point between the highest high and the lowest low over the past 26 days. All of these technical features will make a continuation of the rally “a tough road to hoe”.

August 29, 2023 I am not willing to argue with impulsive rallies and that is what we witnessed in the broader crypto market yesterday as measured by the CCi30 Index. But at the risk of pissing off the bulls I will need to see positive follow through. That said, the sharp drop in the index on August 16th managed to hold the Median Line (purple dotted line) of the Standard Pitchfork (purple P1-P3) and since then (with help from yesterday’s 4.59% short squeeze rally driven by the Greyscale news) both MACD and the Fisher Transform have turned higher through their signal lines but there is formidable resistance ahead. There is a confluence of resistance at the medium (green line) and longer term (blue line) moving averages at 7,820, the Price Activity Band (grey rectangle) and the Upper Parallel (solid purple line) of the Standard Pitchfork. Patience is the key word and don’t let the FOMO devil take control.

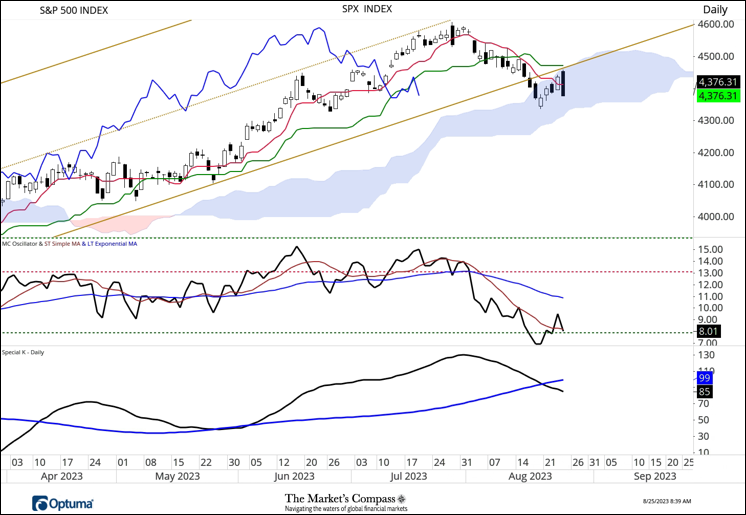

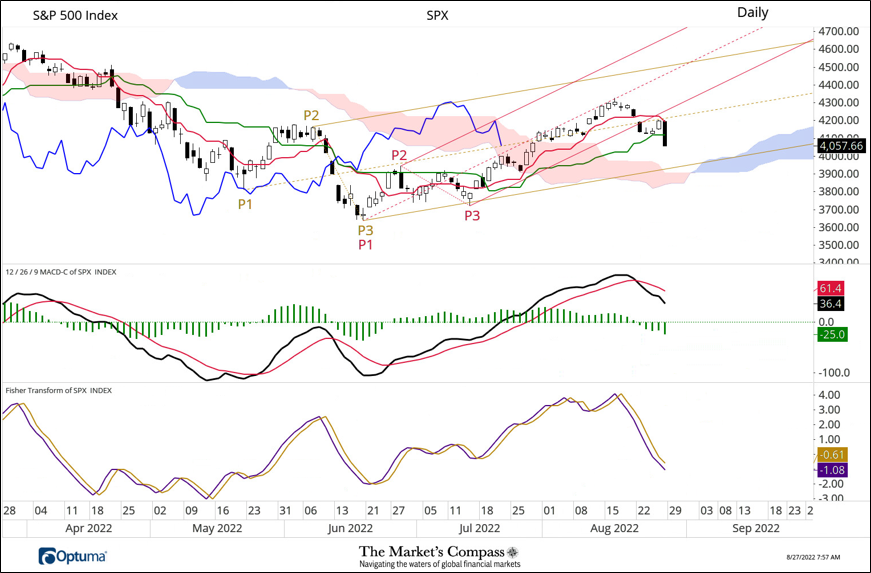

August 27, 2023 On Thursday of last week the SPX started the trading session by attempting to extend a four day counter trend rally from the recent lows but resistance at the Median Line (purple dotted line) of the Schiff Modified Pitchfork (purple P1-P3) capped the early rally attempt and prices traded sharply lower into the end of the day down -59.70 points or -1.35% producing what is known in Candlestick parlance as an Engulfing Candle that is considered a strong negative price reversal. Although downside momentum slowed as a result of the four-day counter trend rally, MACD remains under its signal line in negative territory. My US ETF Daily Momentum / Breadth Oscillator has turned higher over that period from the deeply oversold reading registered the previous week but the SPX is not out of the woods yet considering Friday’s feeble bounce. First resistance remains at the Median Line and second is the Kijun Plot which is at 4,470. Only a rally that retakes the ground above the Cloud and first and second resistance would suggest that the P3 low is more than a short term low.

August 25, 2023 There is absolutely nothing positive to be said about this chart and it’s not just yesterday’s nasty engulfing candle after a failure to retake the ground above broken Lower Parallel (solid gold line) of the Standard Pitchfork and the Kijun Plot (solid green line. Martin Pring’s Special K tells a story of abominable multiple time frame downside momentum. “It isn’t over till the fat lady sings” and she hasn’t even gotten to the theater yet!

August 23, 2023 There are several technical features on the Daily Candlestick Chart that suggest that the rally from the August 15th low has further to run. Silver is rallying sharply today (currently up $0.89 to $24.30) The impulsive rally overtook out potential resistance at the Kijun Plot (solid green line), has punched through the Cloud just ahead of the twist and the Median Line (gold dotted line) of the Schiff Modified Pitchfork (gold P1-P3). When silver prices bottomed and pivoted higher it was in concert with a non-confirmation of Brown’s Composite Index (higher low noted with green dashed line) when RSI traded to a new low. Silver is now posed to challenge resistance at the Upper Parallel of the Pitchfork (gold solid line) which comes in at the $25.35 / $25.40 level.

August 15,2023 I would keep my powder dry even though prices are entering an area of support confluence at the lower Warning Line (purple dashed line) of the Schiff Pitchfork (purple P1-P3), the price pivot support at 4,395 and the Cloud model. Although the Daily Momentum / Breadth Oscillator (SPXDMO) hasn’t fallen to a new low it is well above the March lows that signaled an oversold rally. Only a rally that retakes the ground above the Lower Parallel (solid purple lie) and a follow through above TDST resistance at 4,550 would suggest that the price pullback has run its course.